Why Choose GA Hard Money Lenders for Your Next Real Estate Development Project

Why Choose GA Hard Money Lenders for Your Next Real Estate Development Project

Blog Article

The Ultimate Overview to Finding the most effective Tough Cash Lenders

From examining lenders' reputations to contrasting rate of interest rates and costs, each action plays a vital role in safeguarding the finest terms possible. As you take into consideration these elements, it becomes obvious that the course to identifying the appropriate difficult money loan provider is not as straightforward as it might seem.

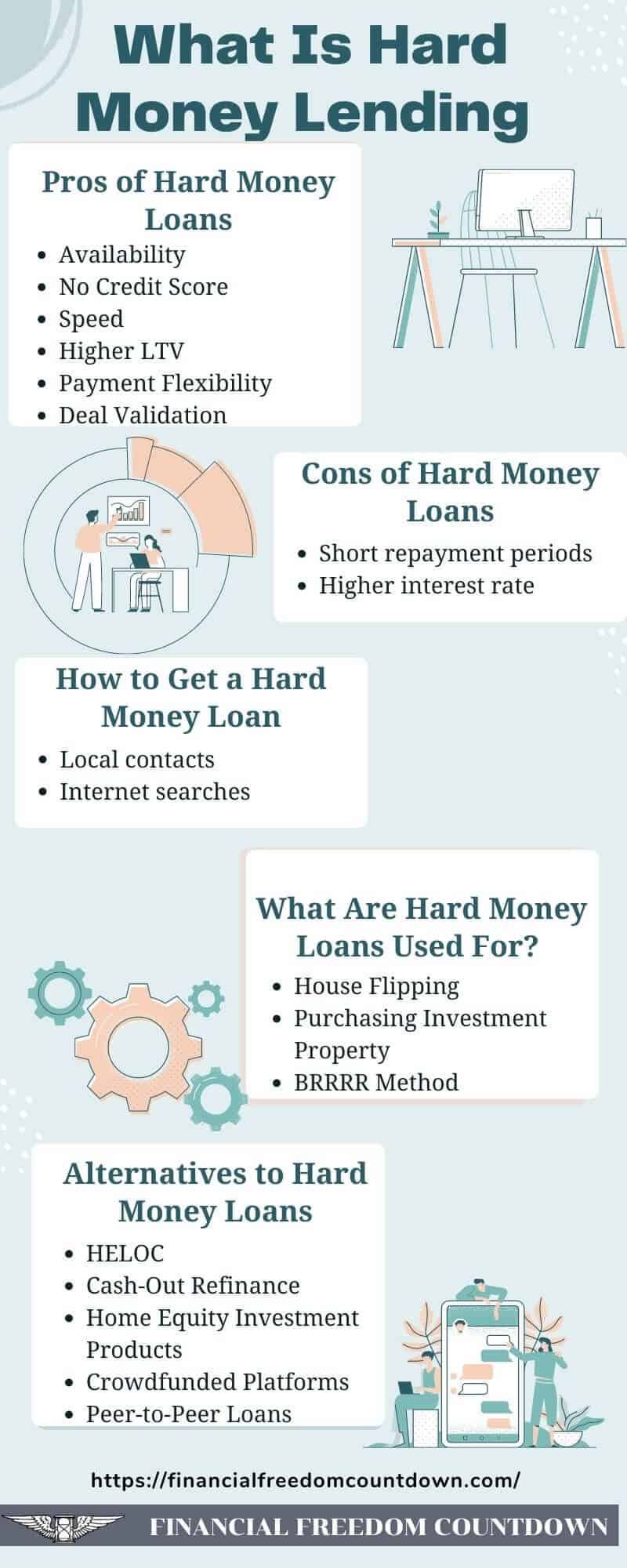

Recognizing Difficult Money Loans

One of the specifying functions of difficult cash financings is their dependence on the worth of the residential or commercial property instead of the borrower's credit reliability. This enables borrowers with less-than-perfect credit rating or those looking for expedited funding to accessibility capital quicker. Additionally, difficult money financings normally come with greater interest rates and much shorter repayment terms contrasted to conventional financings, showing the raised danger taken by lending institutions.

These car loans offer different purposes, consisting of financing fix-and-flip tasks, refinancing troubled residential properties, or giving funding for time-sensitive opportunities. Understanding the nuances of difficult cash car loans is important for investors who aim to take advantage of these economic tools effectively in their real estate endeavors (ga hard money lenders).

Key Elements to Think About

Following, consider the terms of the financing. Different loan providers use differing rates of interest, charges, and settlement schedules. It is important to recognize these terms fully to prevent any type of undesirable shocks later on. Additionally, analyze the loan provider's financing rate; a speedy authorization procedure can be essential in open markets.

An additional critical factor is the lender's experience in your particular market. A loan provider acquainted with regional conditions can provide valuable insights and could be extra adaptable in their underwriting procedure.

Exactly How to Examine Lenders

Reviewing difficult money lenders involves an organized strategy to guarantee you select a partner that straightens with your financial investment objectives. Begin by evaluating the lender's reputation within the sector. Try to find evaluations, testimonials, and any kind of readily available scores from previous clients. A respectable loan provider should have a background of effective deals and a strong network of completely satisfied debtors.

Following, examine the loan provider's experience and field of expertise. Different loan providers might concentrate on various kinds of homes, such as household, read here commercial, or fix-and-flip projects. Select a lending institution whose knowledge matches your financial investment approach, as this knowledge can dramatically impact the approval process and terms.

One more essential factor is the lender's responsiveness and communication style. A trustworthy lending institution should be prepared and easily accessible to address your inquiries comprehensively. Clear interaction during the examination procedure can suggest exactly how they will certainly manage your finance throughout its period.

Last but not least, make certain that the lending institution is clear concerning their procedures and needs. This includes a clear understanding of the paperwork required, timelines, and any kind of conditions that might use. When choosing a difficult money lender., taking the time to review these facets will empower you to make an informed choice.

Contrasting Rate Of Interest Rates and Costs

A detailed contrast of rates of interest and costs among difficult money lending institutions is crucial for optimizing your investment returns. Tough money car loans frequently feature higher interest prices compared to traditional funding, generally varying from 7% to 15%. Comprehending these prices will certainly help you examine the potential prices connected with your financial investment.

In enhancement to rates of interest, it is critical to examine the associated charges, which can significantly affect the overall loan expense. These costs may consist of source fees, underwriting costs, and closing costs, often revealed as a percent of the funding quantity. Origination charges can differ from 1% to 3%, and some lenders may bill additional charges for handling or administrative tasks.

When contrasting lending institutions, take into consideration the complete expense of loaning, which includes both the rate of interest rates and fees. Be sure to make inquiries concerning any kind of possible prepayment penalties, as these can influence anonymous your ability to pay off the car loan early without sustaining additional charges.

Tips for Effective Loaning

Comprehending rate of interest rates and costs is just part of the equation for safeguarding a tough cash funding. ga hard money lenders. To guarantee successful loaning, it is crucial to thoroughly assess your economic circumstance and project the possible return on financial investment. When they comprehend the intended usage of the funds., Beginning by clearly specifying your borrowing purpose; lending institutions are much more most likely to respond positively.

Next, prepare a thorough service plan that describes your project, anticipated timelines, and financial estimates. This demonstrates to lending institutions that you have a well-thought-out method, enhancing your integrity. Additionally, keeping a strong connection with your lending institution can be valuable; open communication cultivates count on and can cause more positive terms.

It is also vital to make certain that your property satisfies the lending institution's criteria. Conduct an extensive assessment and offer all needed documents to streamline the approval process. Be mindful of exit techniques to pay off the financing, as a clear repayment plan reassures lenders of your commitment.

Final Thought

In recap, situating the very best hard cash lenders necessitates an extensive assessment of different aspects, consisting of loan provider track record, finance terms, and field of expertise in property types. Efficient examination of loan providers with comparisons of rate of interest and costs, incorporated with a clear organization strategy and strong communication, enhances the chance of favorable borrowing experiences. Inevitably, attentive study and calculated engagement with loan providers can bring about effective monetary outcomes like this in actual estate undertakings.

Furthermore, tough cash fundings typically come with higher passion rates and much shorter payment terms compared to standard finances, showing the increased threat taken by loan providers.

Report this page