Top GA Hard Money Lenders: Fast Financing for Real Estate Investment Projects

Top GA Hard Money Lenders: Fast Financing for Real Estate Investment Projects

Blog Article

The Ultimate Overview to Finding the most effective Difficult Money Lenders

Navigating the landscape of tough cash loaning can be a complex venture, needing a complete understanding of the numerous elements that contribute to an effective borrowing experience. From evaluating lending institutions' track records to contrasting interest rates and costs, each action plays a critical duty in protecting the most effective terms feasible. Developing efficient interaction and offering a well-structured company plan can substantially affect your communications with loan providers. As you consider these elements, it becomes apparent that the course to identifying the best hard cash lender is not as straightforward as it might appear. What vital understandings could additionally enhance your strategy?

Comprehending Hard Cash Loans

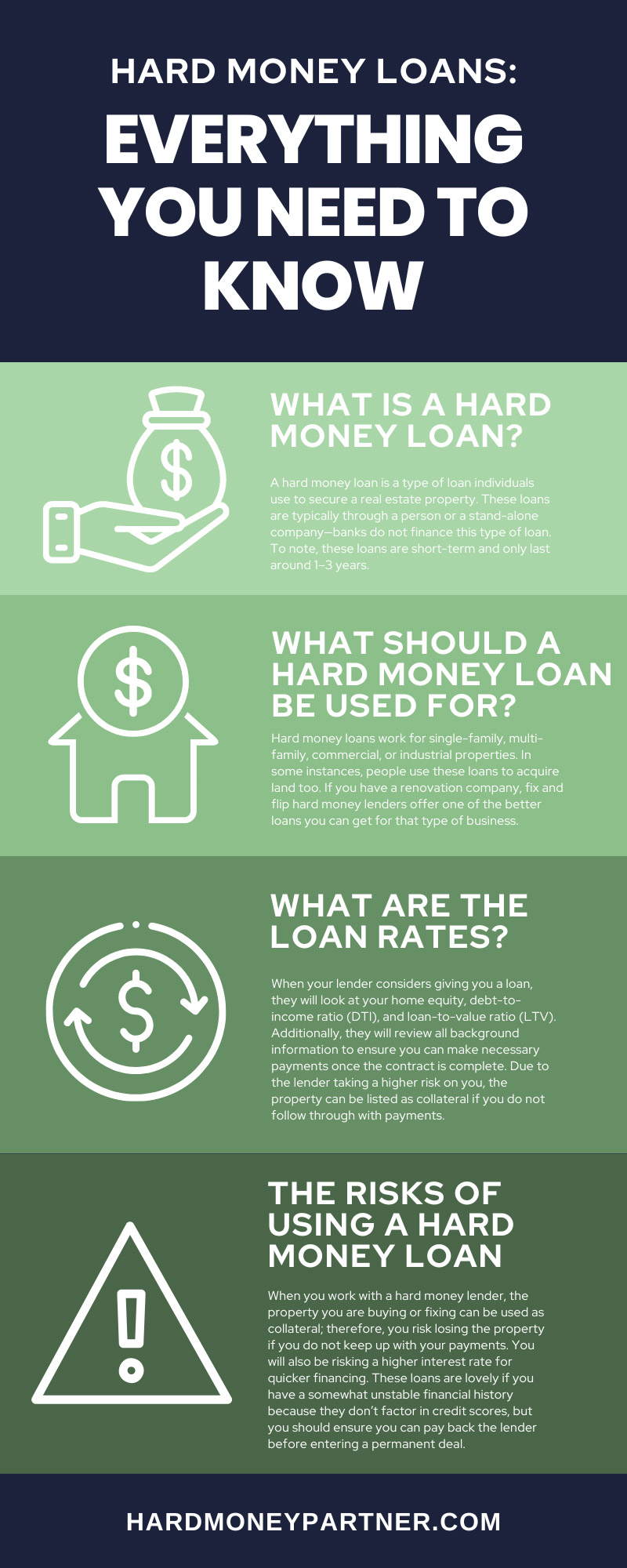

Understanding tough cash financings entails identifying their distinct attributes and purposes within the property financing landscape. These finances are commonly safeguarded by realty and are provided by personal lenders or investment teams, identifying them from standard mortgage products given by banks or debt unions. Hard money financings are mostly utilized for temporary funding needs, commonly assisting in fast purchases genuine estate financiers or designers that need immediate capital for residential or commercial property acquisition or remodelling.

Among the defining features of hard cash finances is their reliance on the worth of the residential property instead of the consumer's credit reliability. This permits debtors with less-than-perfect credit scores or those seeking expedited funding to accessibility capital quicker. Additionally, difficult cash loans generally come with greater rate of interest and much shorter settlement terms compared to conventional fundings, reflecting the increased threat taken by lending institutions.

These lendings offer various purposes, including financing fix-and-flip projects, re-financing troubled properties, or giving funding for time-sensitive possibilities. As such, comprehending the subtleties of tough money financings is critical for financiers that intend to take advantage of these financial tools successfully in their property endeavors.

Key Aspects to Consider

When assessing tough cash lending institutions, what essential aspects should be focused on to ensure an effective purchase? A trustworthy loan provider should have a tried and tested track document of successful bargains and satisfied clients.

Next, think about the terms of the funding. Different loan providers offer differing interest prices, fees, and payment timetables. It is important to comprehend these terms completely to prevent any unpleasant surprises later. In addition, take a look at the lender's financing rate; a swift authorization procedure can be vital in competitive markets.

An additional important factor is the lender's experience in your details market. A loan provider familiar with local conditions can supply valuable insights and may be a lot more flexible in their underwriting procedure.

How to Assess Lenders

Reviewing difficult money loan providers includes a systematic approach to guarantee you pick a companion that straightens with your financial investment objectives. A trustworthy lending institution must have a background of effective purchases and a strong network of completely satisfied borrowers.

Next, take a look at the lender's experience and expertise. Various loan providers may focus on various kinds of properties, such as household, business, or fix-and-flip projects. Choose a lending institution whose proficiency matches your financial investment strategy, as this expertise can dramatically affect the approval procedure and terms.

One more vital variable is the lending institution's responsiveness and interaction design. A reliable loan provider needs to be willing and obtainable to answer your questions adequately. Clear communication throughout the assessment process can suggest just how they will certainly handle your funding throughout its duration.

Last but not least, ensure that the loan provider is transparent about their requirements and procedures. This consists of a clear understanding of the paperwork needed, timelines, and any kind of problems that may use. Putting in the time to evaluate these aspects will equip you to make a notified decision when choosing a difficult cash lending institution.

Comparing Rate Of Interest Prices and Costs

A comprehensive contrast of rate of interest prices and charges among tough cash lenders is vital for optimizing your investment returns - ga hard money lenders. Hard cash loans frequently include greater rate of interest compared to traditional funding, usually varying from 7% to 15%. Comprehending these rates will assist you assess the potential expenses connected with your financial investment

In enhancement to interest prices, it is vital to assess the associated fees, which can dramatically influence the overall loan price. These charges may include origination fees, underwriting fees, and closing expenses, usually shared as a portion of the loan amount. For circumstances, source charges can vary from 1% to 3%, and some lending institutions may charge extra fees for handling or administrative jobs.

When comparing lending institutions, take into consideration the total expense of borrowing, which incorporates both the rates of interest and costs. This holistic technique will allow you to recognize the most affordable alternatives. In addition, make certain to ask about any type of possible early repayment charges, as these can impact your capability to settle the loan early without incurring extra costs. Eventually, a careful evaluation of rates of interest and costs will result in more educated borrowing decisions.

Tips for Effective Borrowing

Next, prepare an extensive organization strategy that describes your job, expected timelines, and economic estimates. This shows to lenders that you have a well-thought-out approach, this article boosting your credibility. In addition, keeping great site a strong connection with your lending institution can be valuable; open interaction promotes trust fund and can bring about extra positive terms.

It is likewise necessary to make certain that your property fulfills the loan provider's requirements. Conduct a complete evaluation and supply all required paperwork to streamline the authorization procedure. Be conscious of departure strategies to pay off the funding, as a clear settlement strategy guarantees loan providers of your dedication.

Conclusion

Furthermore, hard money car loans typically come with greater rate of interest rates and much shorter repayment terms contrasted to conventional loans, reflecting the boosted danger taken by lending institutions.

When examining difficult money loan providers, what key aspects should be focused on to make certain a successful deal?Evaluating tough money loan providers includes a methodical technique to guarantee you choose a partner that lines up with your click for more financial investment goals.An extensive comparison of interest prices and costs amongst tough money loan providers is essential for maximizing your financial investment returns. ga hard money lenders.In summary, situating the ideal tough cash loan providers necessitates an extensive evaluation of numerous elements, including lender track record, lending terms, and specialization in home types

Report this page